Why I Changed My Mind On Bitcoin

The Narratives Were Wrong But the Investors Were Right

Back in 2012, when it was trading for $5 per coin, I had a synchronized Bitcoin node on my laptop. I was always more of a technologist than an investor, and so I was much more interested in the concepts of digital cash and Bitcoin mining, along with the ideological promises of an uncensored currency and an escape from inflationary central bank fiat currency than I was in finding ways to multiply my money. The main bitcoin exchange was the now-defunct Mt. Gox, a site originally created as a secondary marketplace for Magic: The Gathering trading cards but had the first-mover advantage.

At the time, Bitcoin looked like a moonshot, and the feeling that one would “invest” in Bitcoin had the same feeling as saying you should, “invest” in Beanie Babies or Magic: The Gathering cards. It didn’t feel responsible. I spent far too much time idly tossing the idea around in my head being needlessly scrupulous about investing before deciding, “Ok, I’ll put $100 in it.” I procrastinated a week or two and it happened that the price shot up to $10 per coin, giving me the sinking feeling that I had waited too long and was now buying at the top of the market, so I balked and walked away.

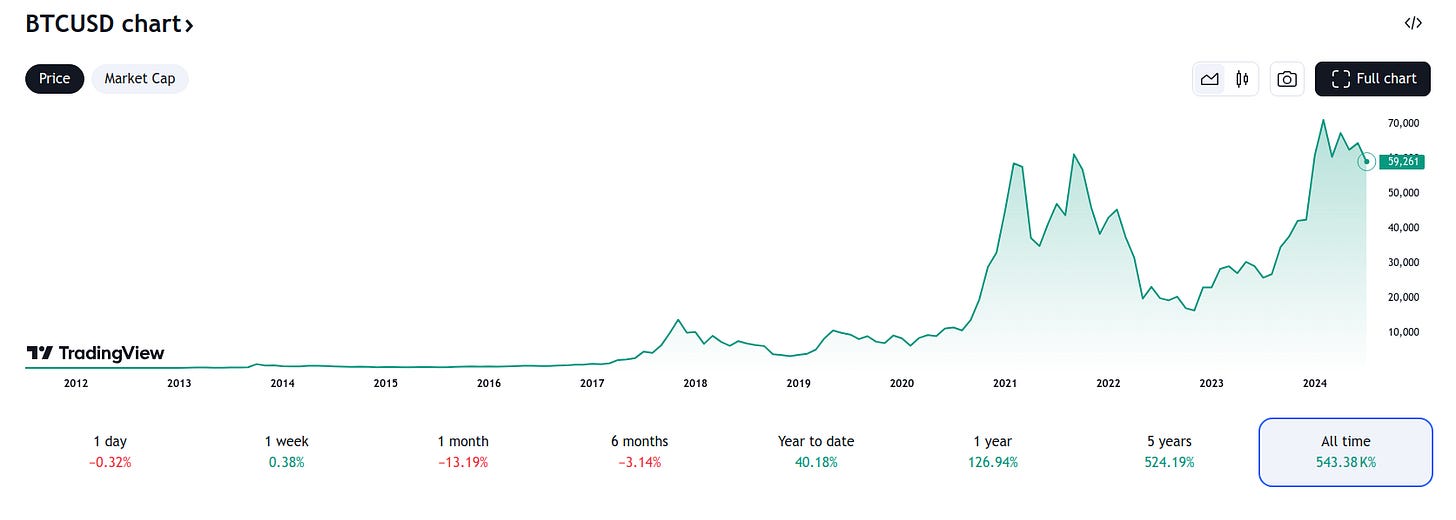

Though 2024 bitcoin prices are around $60,000, I don’t kick myself too much over this five to six-figure bad decision because I know that if I had pulled the trigger and bought 10 bitcoins at $10 each, I would have likely been content with doubling my money and sold at $20, or else at $1000. Hindsight is 20-20, and no amount of knowledge about technology or even investing can overcome a deficiency in yourself, like an irrational fear of losing an unimportant amount of money from a bad investment.

In my mind, I had linked my analysis about the future of Bitcoin and blockchain technologies with the narrative claims behind them, and assumed the correctness of those claims, whether ideologically or technically, would translate to the long term future of Bitcoin and blockchains.

Being involved pretty close to the beginning, I was able to observe the shifts in the Bitcoin narratives over the years.

A Private Stateless Digital Currency Promoting Agorism

An uncensorable token of exchange preventing cancellation or enabling digital black markets or grey markets

Blockchain as the driver of Web 3.0

The future of the world’s money

A store of value that cannot be inflated

The next global reserve currency

A national strategic asset

A mode of military force projection in cyberspace

When we broaden the topic out to blockchain technology in general, there is even more:

Private transactions

Smart Contracts

Meme Coins

Decentralized Finance

NFTs and Art Investment

We could examine these narratives at length, and I can find both merit and flaws in each one. However, this misunderstands a fundamental aspect of investing, a misunderstanding that I had for a long time and many others share. That is the role of narrative in investment, but before we can understand that, we first must understand the three different paradigms of investment.

The Three Eras of Investing

I divide investing into three eras: the premodern, the modern, and the postmodern. These are not necessarily distinct periods of time as much as they are attitudes and beliefs. A premodern economy is organized around tradition, family, and religion, and investment was mostly an extension of one’s own industry, like buying a field to raise cattle or plant a vineyard. The idea of money working by itself was a foreign concept viewed with suspicion if not condemnation. Think of King Solomon as a paradigmatic figure of premodern economics.

Modern economies are organized around precision and scientific measurement. Money, growth, value, and interest became abstract parameters which can be studied and applied with an engineering mindset. A modern economy thinks about productivity in terms of using capital to innovate and create value, with profit and returns being a reward for value creation. Think of Henry Ford as a paradigm for modern economics.

Finally, a postmodern economy is organized around narrative. Just as the postmodern philosophers amplified and deconstructed the contradictions of scientific certainty in philosophy, postmodern economics deconstructs the concept of value investing and underlying assets and the basic purposes of economies to produce and organize wealth through the use of narrative. Think of George Soros as a paradigm of postmodern economics.

Considering the American economy, what paradigm do you think dominates?

The Shifting Bitcoin Narrative

When I thought about Bitcoin and blockchain, for a long time, I approached them with a modern mindset: that Bitcoin derives its value from its usefulness for any given purpose, and thus the claims about its future purposes and uses were fundamental to the question of its future value.

Nevertheless, over 10 years of observation I watched as the narrative continued to change. Bitcoin transactions are too slow and expensive to settle on its blockchain for everyday use buying groceries, and these costs would only increase the more people who were using it. The blockchain is also not private, making it easy for strangers to know how much you have and all of your purchasing history with that wallet. Know Your Customer laws require exchanges to verify real identities, destroying anonymity for most crypto at scale and adding squeeze points for governments to manipulate crypto. Bitcoin does not seem well suited to act as a currency, despite being right there in the name, “cryptocurrency.” Different people addressed this objection in different ways. Some pointed to the Lightning Network, an optional added layer that could improve the speed and cost of transactions using a convoluted IOU scheme. You could also substitute in an altcoin that is cheaper to transact with, since you could easily convert that altcoin into cash or bitcoin when you were done. Others answered that Bitcoin never was a currency, but a store of value. Just like you don’t get gold coins to buy groceries but you still want them. Bitcoin isn’t about transactions, but holding. However, Bitcoin has historically followed the patterns of the stock market, rather than remaining independent, so if you’re going to put money into risky assets, why choose a digital token when you can choose a company that actively makes profit?

The “currency” narrative is dead.

Realistically, the anonymity and black market narrative is dead as well, since those using it for illegal purposes are protected by geography, not technology.

Grey market uses, like the funding of the ideologically uncensored social media site Gab are still challenging, as its founder has been banned from at least one major exchange. Other grey market uses like gambling are getting undermined by the mass-legalization of gambling in general.

It seems like all of the bitcoin narratives so far have either proven underwhelming or are hyperbolic speculations off in the future.

Still, the whole time, the price of Bitcoin has gone up. Bitcoin has been completely unphased by any of the failure of its narratives to live up to their hype. If anything, the more the narratives are dashed, the more Bitcoin goes up.

Why is this Happening?

If you said, “central banking and fiat currency,” you are only partially right.

Fiat currency, inflation and low interest rates explain asset prices rising, but they don’t explain why it shows up in Bitcoin. Other cryptocurrencies did not see the same gains, and the stock market heat is concentrated in a few powerful stocks rather than the whole market. The biggest stock as of 2024 is Nvidia with a market cap of about $3T and the entire US stock market has a market cap of around $51T. Bitcoin, in comparison has a market cap of about $1T. These numbers are constantly changing, but the market clearly believes that Bitcoin is a uniquely good place to put money.

Why? The answer is simple: supply and demand.

Bitcoin is valuable because people want it and there is a limited amount.

We can rehearse all the reasons why logically it doesn’t make sense that people would want Bitcoin, but it ignores the fact that people do want it, and they are extremely loyal.

Imagine gathering a room full of people together and telling them that there is no logical reason they should want an iPhone because Android phones are superior. It denies the evidence right in front of you that over half of them want iPhones. Some will say, “It’s what I know,” others will say, “Its easier to use,” and others will say, “I am in the Apple ecosystem,” while still others may believe verifiable falsehoods about it, but still choose iPhone anyway.

Each Bitcoin investor has his own reasons for buying and holding Bitcoin. Maybe they believe one of the precarious narratives about its uses, or they believe falsehoods about the underlying technology, or they predict future events will drive even more demand for Bitcoin. It doesn’t matter if they are right. It matters that they want it and plan to reliably buy it forever.

Bitcoiners do not have to agree on the future of Bitcoin, they just have to agree that Bitcoin is the future. By coming to that agreement, it ceases to be a prediction and becomes a manifestation. When assets attract demand, their prices go up, and when you invest in assets whose prices go up it demonstrates that the asset is a high performer, which itself is what people are looking for in an investment.

Even if you completely disbelieve the claims of Bitcoin and its future, you may still believe that other people believe in it, and if you are right, then it is still rational to want to invest in it.

Bitcoin’s market cap managed to reach a value of nearly 2% of the stock market’s total value while still considered fringe and controversial. As people get used to Bitcoin, it will become increasingly normalized. Ivy League graduates are emerging from universities enthusiastic about the promises of DeFi (rebuilding financial services with blockchain technology) with traditional finance being seen as old and slow, relying on privileged positions with government and their momentum.

We’re already seeing political figures speak enthusiastically about Bitcoin, including Donald Trump and Robert F. Kennedy Junior. There are discussions about nations buying strategic reserves of Bitcoin, Bitcoin gaining tax privileges, and other bullish positions.

Even if this represents the most extreme case, there is plenty of room for a government to go part of the way.

We can also consider the logic of a “national strategic reserve.” If a national superpower decides to strategically stockpile bitcoin, it benefits to be the first, so there would likely be reciprocal action from other superpowers.

Economic Alchemy

Our language about the economy is modern. We use words like “productivity” and “returns,” and “value,” to describe the increase of the cost of investment assets, but we live in a postmodern economy. We look at metrics like “earnings” for stocks and assume that higher earning stocks will become more valuable, but that value is driven by demand for the stock, not the stock’s performance. Earnings are obviously a major signal to investors, but it can cloud the fact that it is just one reason people want the stock, and those reasons can be as diverse as the investors. Is Elon Musk entirely unrelated to the performance of Tesla stock? Is Gamestop stock driven purely by a set of beliefs about the sales of game consoles in physical retail stores?

If a modern economy is a science, like chemistry, a postmodern economy is alchemy: the use of the tools of science mixed with the esoteric and subjective to spin straw into gold.

One thing is certain: the people who predicted the death of Bitcoin have been wrong. In the face of mainstream opposition, Bitcoin already has roughly 2% of the market cap of the stock market, which is enough to prove this is not just a passing fad. The market has spoken. If Bitcoin sticks around, most investors will probably want at least a little of their portfolio in it if not a serious position.

I can now see how I was wrong about Bitcoin by being right. I was able to predict some of Bitcoin’s shortcomings, but I never imagined that its future didn’t depend on overcoming them.

I am not a financial advisor and this is not financial advice. What you decide to do with this information is up to you. Whatever you decide, I wish you the very best for your future prosperity.

Thank you for reading, and thank you even more for those who have supported this publication. Everyone’s comments, messages, and financial contributions have been so encouraging so far, and I would have never continued writing without this support. Until next time.